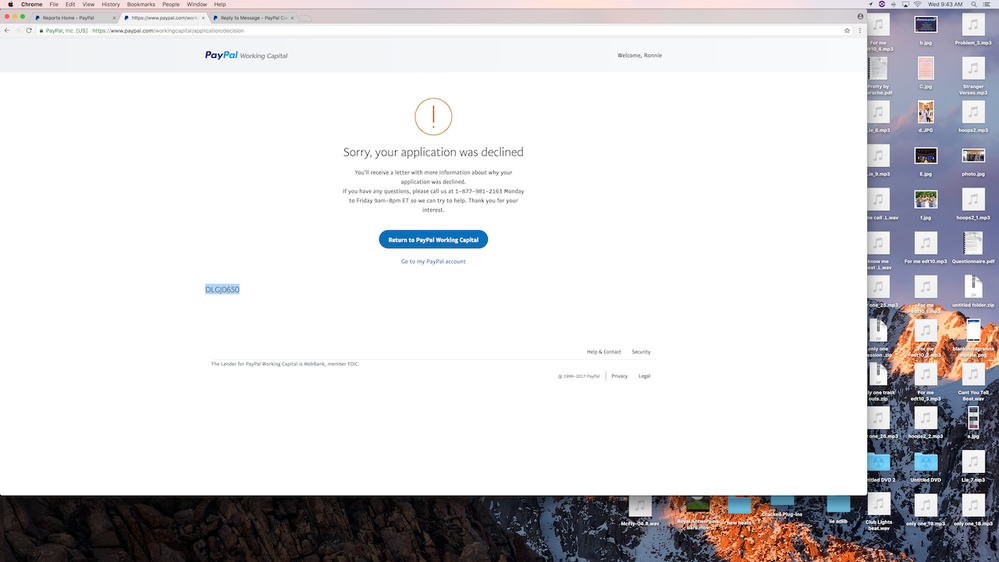

Working Capital 4th loan application denied with error code 650. Does anyone know why?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello all,

I am trying to apply for my 4th PayPal working capital loan and am not getting approved. I had 3 loans within the past year and a half and paid them all off ahead of time. The last loan I had I paid off 2 weeks ago and used few thousand dollars to bring it to zero balance. I thought I will get approved right away just like all the previous loans, so I could buy new inventory but I keep getting an error message 650 😞 If I knew I would not get approved I would have used the cash I had to buy new inventory instead of paying the loan off early 😞 I called and they keep telling me to try more so I have been trying every single day. I really need to get restocked because less inventory I have less sales I am showing.

Please let me know if anyone has any suggestions.

Thank you

Veronika

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Has anyone gotton approved recently? I just payed my 3rd loan off and will be applying again on Monday.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Here is my experience, its a bit longwinded so bear with me. In a nutshell, I both got a loan and got declined for a loan.

I took out two working capital loans from my paypal business account, paid one off early, took a second larger one out, paid that off early (both loans paid off with a lump sum payment) and declined for a third loan 2 months ago. Code was 646 at first, which is the supposed "fluctuation in sales" code. My business typically slows done in the summer. It just so happens though that I got a strong pick up in business over the last two months though so I kept reapplying. Then the code turned to the 700s, which is supposed to be that you have another loan with them. I do have a personal paypal account, from many years ago when I used to just sell on ebay. I had taken a working capital loan out over a year ago and had a balance. I did a few sales on ebay and then paid off that loan with a lump sum (day 389). I then reapplied for a working capital loan on the business account. Declined, code is 650 (fluctuation). That account has had pretty steady sales over a year, maybe a month in that period that was 20-25% less then the other months. I applied for a working capital loan from my personal account (the day after paying it off). Got approved. Higher repayment rate (30%) but the same amount as the last loan. This is an account where I liquidate the occasional left over inventory from my business. I'll sell a bunch of stuff one month, then not sell anything for 2-3 months. That is fluctuation. But they gave me a loan in that account.

My take on all this is that paypal is going through growing pains/preparing expansion of the working capital product. The computer algorithm is just spewing off codes that in many cases don't make sense. This isn't some "glitch" that all of a sudden in the last 6-8 months has started popping up that they can't figure out. I think they are just not making a lot of loans right now, and probably very few big dollar loans. I think they will either be rolling out another higher margin product, as working capital right now is very cheap to the borrower or they are working on getting more financing, reworking the fee structure and reworking the software. They recently purchased another working capital lending firm, Swift Financial, in order to "bolster their small business loan underwriting capabilities". In a story about the transaction is the following:

"In a memo to PayPal staff, Esch said his company last winter had worked with Swift Financial to build and test a new service, PayPal Business Loan, and was "impressed with their ability to deliver on an unmet need" for mid-market-sized customers larger than current PayPal borrowers. "It quickly became clear that combining our complementary capabilities and people will allow us to accelerate" and fill what he calls a "funding gap" for business cash."

Paypal has lent $3bln through working capital, Swift has lent $1.5bln but their loans tend to be larger then paypal's and then there is also this nugget:

"Swift makes "cash advance" loans and arranges their repayment from borrowers' revenues, at rates similar to credit card rates, which are higher than typical bank business loans. For larger loans, it offers "same-day answer" and next-day cash through bank loans arranged via Celtic Bank of Utah. Compared to bank loans, "it's like Fed Ex vs. the post office" -- you may pay more for quicker service, Harycki said."

So my expectation is to expect laons to start becoming available towards the end of the year (that is when Swift will be integrated into Paypal), probably larger than what you have been offered previously, at probably 2-3x the cost of previous loans.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Relax everyone reading these posts and panicing. ![]()

I paid off my 4th paypal loan yesterday with a lump sum about lunch time.

5th loan approved 9am this morning, larger than the last one.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wanted to update everyone.

On 5/29 I paid off a 37k loan with a lump sum of around 3k.

Rejected with error code 650 from 6/2 until 6/9.

Rejected with error code 640 from 6/9 until 9/4.

9/4 Approved.

Applied daily or every other day during this period.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I wish someone would have told me this before I wasted a large lump sum of money on paying off my working capitol loan. This is to help people who get the error code: 650 or DLGJ0650. The rep said that the system qualifies you for a loan based on annual sales but the actual loan amount if any is based on the previous 3 months of sales not including the month you are applying. For example it is October now. The system is looking at July, August and September. So before paying off a loan with the expectation to re apply please use the paypal insights to see what your last 3 months were. If they were low you should wait. The system will reupdate according to the rep on the second week in November. So the new criteria will be August September and October. I hope this helps those who are looking to pay off a loan early with plans on a new loan immediatly. They also have an option to get refunded your manual payments under certain conditions if you really need the money. They told me to keep applying as my times a day as I want. However she noted they rebatch the second week of each month.

Haven't Found your Answer?

It happens. Hit the "Login to Ask the community" button to create a question for the PayPal community.