VAT not being added on

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

(Originally posted in the community help forum - but probably more appropriate here).

I have a PayPal shopping cart setup on my website with each add-to-cart button having its own tax override values per item. I do it this way because some of the items I sell (books) are zero-rated for VAT and so I can't have a blanket 20% for the whole shopping cart total. The button code is created by a Java script for each item (my website has 1000s of items so hard-coded buttons aren't an option).

In orders that arrived on the 27th December this was working fine - in orders dated the 28th, it isn't. I've just replicated a recent customer's order on my own PC and what happens is that the VAT is correctly calculated and added in the shopping cart, but as soon as I checkout this disappears and is replaced by a figure of 20p, which equates to the VAT on the cart handling amount, regardless of the shopping cart total.

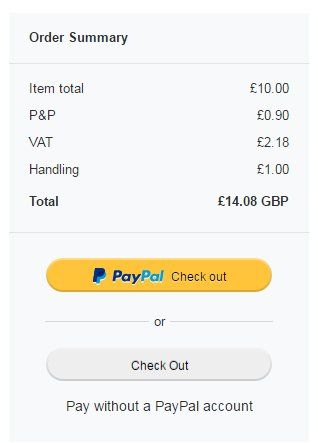

I've taken screen shots of the process - the first shows the shopping cart total after I've added the item, the second shows the cart after I've hit checkout and tried to pay. In the first, VAT is listed as £2.18 (which is incorrect - it should be £2.38, 20% of items + shipping + handling - the handling %age is missing) whereas in the second it's changed to £0.20 (20% of the handling amount) Anyone have any ideas ? I'm probably doing something daft but I can't work out what has changed to cause this to happen.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

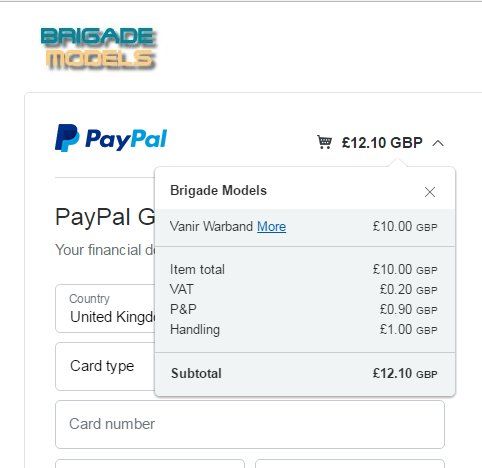

I've run a quick test on your store, with a UK account, found the same item, to be sure, and it doesn't seem to be reproducible any more:

Can you still reproduce it?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi - thanks for the reply.

I've found a workaround by using the default VAT settings for most items (so omitting the "TAX=" override) and just using the override for books, which are zero-rated. This works, but I suspect if I was to set the override to anything but zero (say 10%) then it wouldn't. Fortunately we only sell items which are either standard rated (20%) or zero rated, so I get away with it.

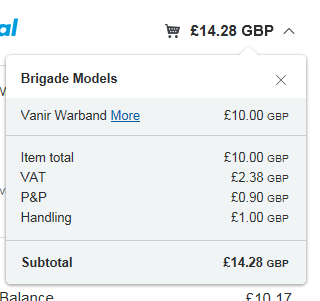

I've just found that it is still possible to reproduce the bug. Starting from an empty cart, if you add just a book (say this one - http://www.brigademodels.co.uk/ImperialSkies/Items/ISK-001.html) and then checkout, then a mysterious VAT value of £0.20 appears.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Thank you, this actually sheds light at the problem. In the POST string the shop sends to PayPal there is, as you said, tax=0.00. This tax override applies to the line item in the cart and the shipping. However, handling_cart=1.00 encompasses the entire cart and variables affecting only the line item won't have any effect on it. Therefore, the rate from your PayPal account is applied to handling_cart.

Try with and without handling_cart:

Haven't Found your Answer?

It happens. Hit the "Login to Ask the community" button to create a question for the PayPal community.

- the make custom button does not display the memo field even though i added one in PayPal Payments Standard

- PERMISSION_DENIED error for checkout/orders/{order_id} endpoint in REST APIs

- I get always the error: "invalid client_id or redirect_uri" from signin authorize endpoint. in Braintree Server-side Integration (PHP, Java, .NET, Ruby, Python, NodeJS SDKs)

- Not seeing client in Switch Profiles in Developer area in Sandbox Environment

- Add to cart button is missing? in PayPal Payments Standard