- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solved! Go to Solution.

- Labels:

-

PayPal Credit

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Yes, it was a recent change brought in from May 1st. PayPal Credit now charges interest on top of interest.

You should have gotten an email explaining the changes.

The table they include in the email is most likely not going to apply to most people. The difference between the two systems is shown as a mere £2.78 over a 12-month period, assuming someone borrowed £100 of credit. In reality, if you owe £1,000 and you can only afford the minimum payment, you will be much worse off with the new system.

I am fairly sure that this change is to offset the amount of payment relief they offered during the pandemic. However, to be perfectly honest, I am not quite sure how PayPal can justify these changes in the midst of a global cost-of-living crisis. It seems like a decision that is rather ignorant to the current situation that most people find themselves in, through very little fault of their own.

The email reads as follows:

In March, we let you know about a change to the way interest would be charged on your PayPal Credit account. This change came into effect on 1 May, so we wanted to take the opportunity to remind you of it and explain the effect it will have.

We are moving from charging simple interest on your account to charging compound interest. This does not involve any change to your PayPal Credit agreement, but instead aligns our approach with what is already detailed in condition 4.6 of your PayPal Credit agreement. You can read your terms here.

What does applying compound interest mean?

Applying compound interest means that we will start to charge interest on interest as well as on the outstanding amount if you do not pay off your balance in full every month. This means that you may be charged more interest each month, depending on how you use PayPal Credit. The more quickly you clear your balance, the less you will pay in compound interest.

Any promotional balances on your account, such as any 0% for 4 month offers or instalment offers that you have, will be unaffected. Offers that apply interest will continue to be charged simple interest and the cost of credit will not change from what was explained at the time of purchase.

If you are currently not being charged interest (for example, if you are experiencing financial difficulties and we have agreed to enter into an interest-free period) then this change will not impact you, but it might in the future. This is why we are letting you know about it now.

An example of how this works

We have set out an example below to help explain how compound interest can impact an account. This is just intended to help make the different ways of charging interest clear, is not related to any specific PayPal product.

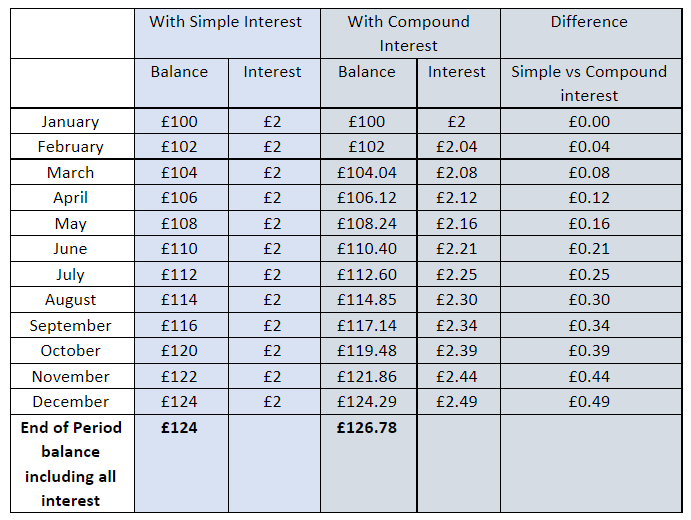

Let’s say that John made a purchase of £100 in December and does not have to pay anything back for 12 months. He is charged interest for the first time in January, based on a 24% annual rate. In this basic example, if John is charged simple interest, he will pay an interest charge of £24 over a 12-month period. If John was charged compound interest, he would be charged an interest charge of £26.78 over the same period. This would be a total of £2.78 additional interest over 12 months.

On a monthly basis his interest cost would gradually increase and the difference between the simple and compound interest charged would increase from around 5p to 50p per month over the 12 months.

Please refer to the monthly breakdown below as an illustration. Please remember that this is just a basic example to help explain how interest is calculated. It doesn’t reflect how PayPal Credit works or take into account the need to make monthly minimum payments.

You must make at least the minimum payment amount each month with PayPal Credit. If you don’t pay your monthly minimum payment on time, you may be charged a fee and could be reported to Credit Reference Agencies.

Clearing your balance in full every month can help you pay less in interest than if you only pay the minimum payment amount or partly pay the balance. If you do not clear the balance each month, paying earlier or making more than one payment a month may also help reduce interest charges.

What if I need help?

If you have any other questions or are concerned the change could have an impact on your current financial situation (for example, repayments will no longer be affordable) then please contact us via CHAT by logging in here and selecting new message or call us on 0800 368 7155.

Alternatively, you can find free, independent help and support with money matters through:

- The Government's MoneyHelper service

- PayPlan

- StepChange

Thanks for being a PayPal Credit customer.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Yes, it was a recent change brought in from May 1st. PayPal Credit now charges interest on top of interest.

You should have gotten an email explaining the changes.

The table they include in the email is most likely not going to apply to most people. The difference between the two systems is shown as a mere £2.78 over a 12-month period, assuming someone borrowed £100 of credit. In reality, if you owe £1,000 and you can only afford the minimum payment, you will be much worse off with the new system.

I am fairly sure that this change is to offset the amount of payment relief they offered during the pandemic. However, to be perfectly honest, I am not quite sure how PayPal can justify these changes in the midst of a global cost-of-living crisis. It seems like a decision that is rather ignorant to the current situation that most people find themselves in, through very little fault of their own.

The email reads as follows:

In March, we let you know about a change to the way interest would be charged on your PayPal Credit account. This change came into effect on 1 May, so we wanted to take the opportunity to remind you of it and explain the effect it will have.

We are moving from charging simple interest on your account to charging compound interest. This does not involve any change to your PayPal Credit agreement, but instead aligns our approach with what is already detailed in condition 4.6 of your PayPal Credit agreement. You can read your terms here.

What does applying compound interest mean?

Applying compound interest means that we will start to charge interest on interest as well as on the outstanding amount if you do not pay off your balance in full every month. This means that you may be charged more interest each month, depending on how you use PayPal Credit. The more quickly you clear your balance, the less you will pay in compound interest.

Any promotional balances on your account, such as any 0% for 4 month offers or instalment offers that you have, will be unaffected. Offers that apply interest will continue to be charged simple interest and the cost of credit will not change from what was explained at the time of purchase.

If you are currently not being charged interest (for example, if you are experiencing financial difficulties and we have agreed to enter into an interest-free period) then this change will not impact you, but it might in the future. This is why we are letting you know about it now.

An example of how this works

We have set out an example below to help explain how compound interest can impact an account. This is just intended to help make the different ways of charging interest clear, is not related to any specific PayPal product.

Let’s say that John made a purchase of £100 in December and does not have to pay anything back for 12 months. He is charged interest for the first time in January, based on a 24% annual rate. In this basic example, if John is charged simple interest, he will pay an interest charge of £24 over a 12-month period. If John was charged compound interest, he would be charged an interest charge of £26.78 over the same period. This would be a total of £2.78 additional interest over 12 months.

On a monthly basis his interest cost would gradually increase and the difference between the simple and compound interest charged would increase from around 5p to 50p per month over the 12 months.

Please refer to the monthly breakdown below as an illustration. Please remember that this is just a basic example to help explain how interest is calculated. It doesn’t reflect how PayPal Credit works or take into account the need to make monthly minimum payments.

You must make at least the minimum payment amount each month with PayPal Credit. If you don’t pay your monthly minimum payment on time, you may be charged a fee and could be reported to Credit Reference Agencies.

Clearing your balance in full every month can help you pay less in interest than if you only pay the minimum payment amount or partly pay the balance. If you do not clear the balance each month, paying earlier or making more than one payment a month may also help reduce interest charges.

What if I need help?

If you have any other questions or are concerned the change could have an impact on your current financial situation (for example, repayments will no longer be affordable) then please contact us via CHAT by logging in here and selecting new message or call us on 0800 368 7155.

Alternatively, you can find free, independent help and support with money matters through:

- The Government's MoneyHelper service

- PayPlan

- StepChange

Thanks for being a PayPal Credit customer.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I feel like you should be safe from any kind of interest during a promotional interest-free period, providing you pay it back within that time frame.

Still, this change is a huge kick in the teeth to what I imagine may be a significant number of PayPal Credit customers.

Haven't Found your Answer?

It happens. Hit the "Login to Ask the community" button to create a question for the PayPal community.

- Will Debt Management Plan affect my ability to use PP for buying & selling? in Products & Services Archives

- Is PayPal going to pay interest on the balance as they have in the past? in Wallet Archives

- I've been accepted for PayPal credit, have I automatically got the 0% interest rate on purchases? in Products & Services Archives

- What is the current interest rate for PayPal? in Products & Services Archives

- USD Withdrawal to Europe IBAN USD account - is it possible? in Transactions Archives